Background

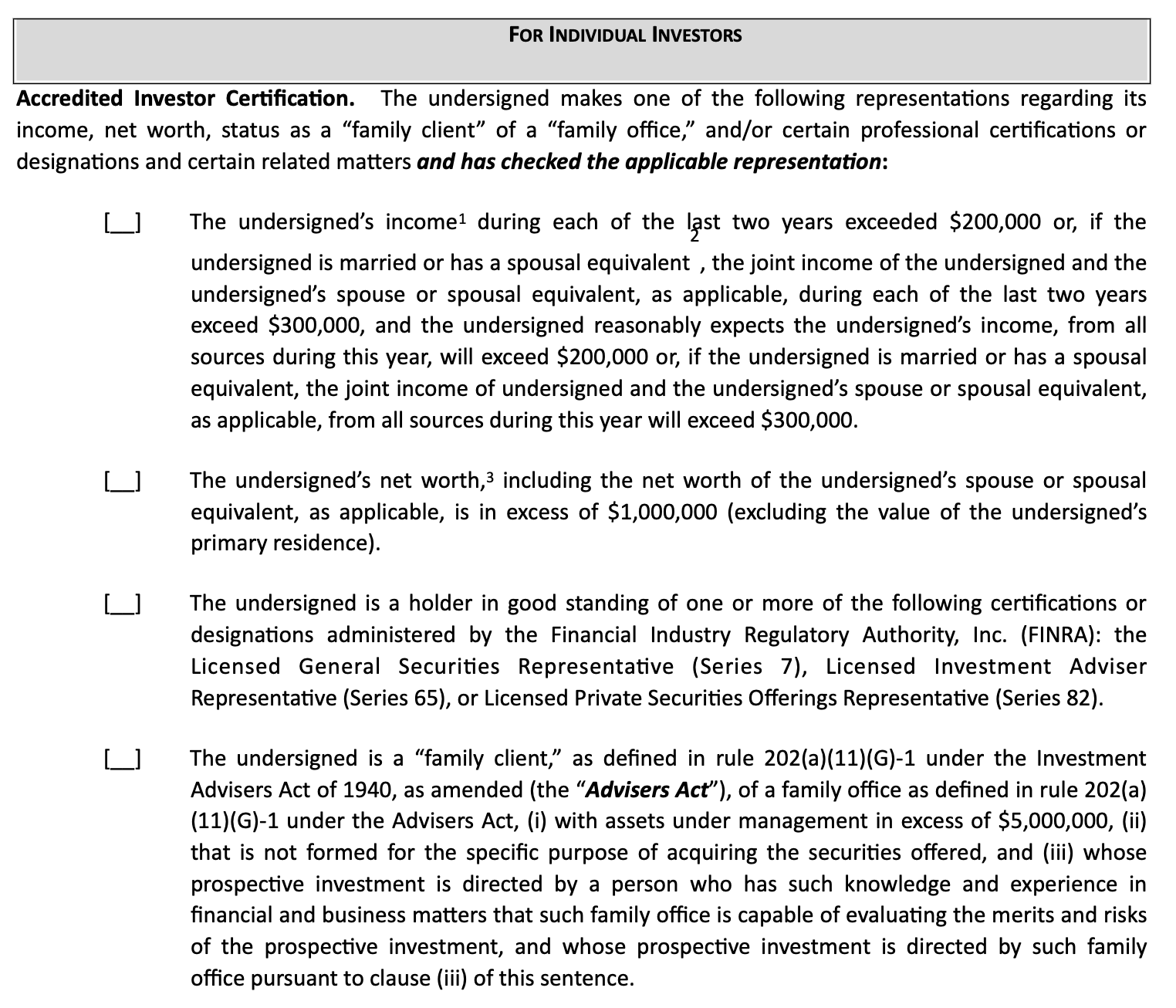

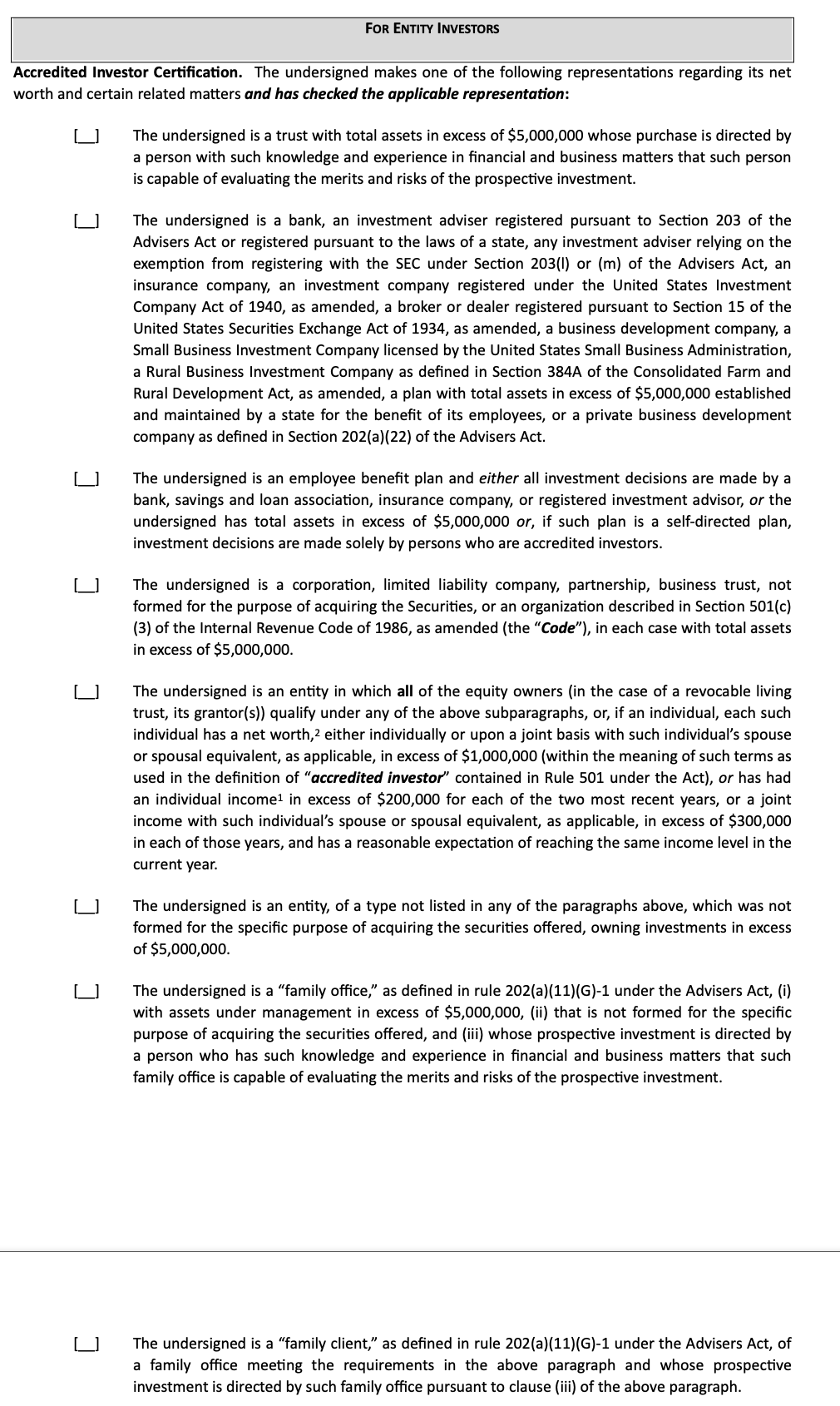

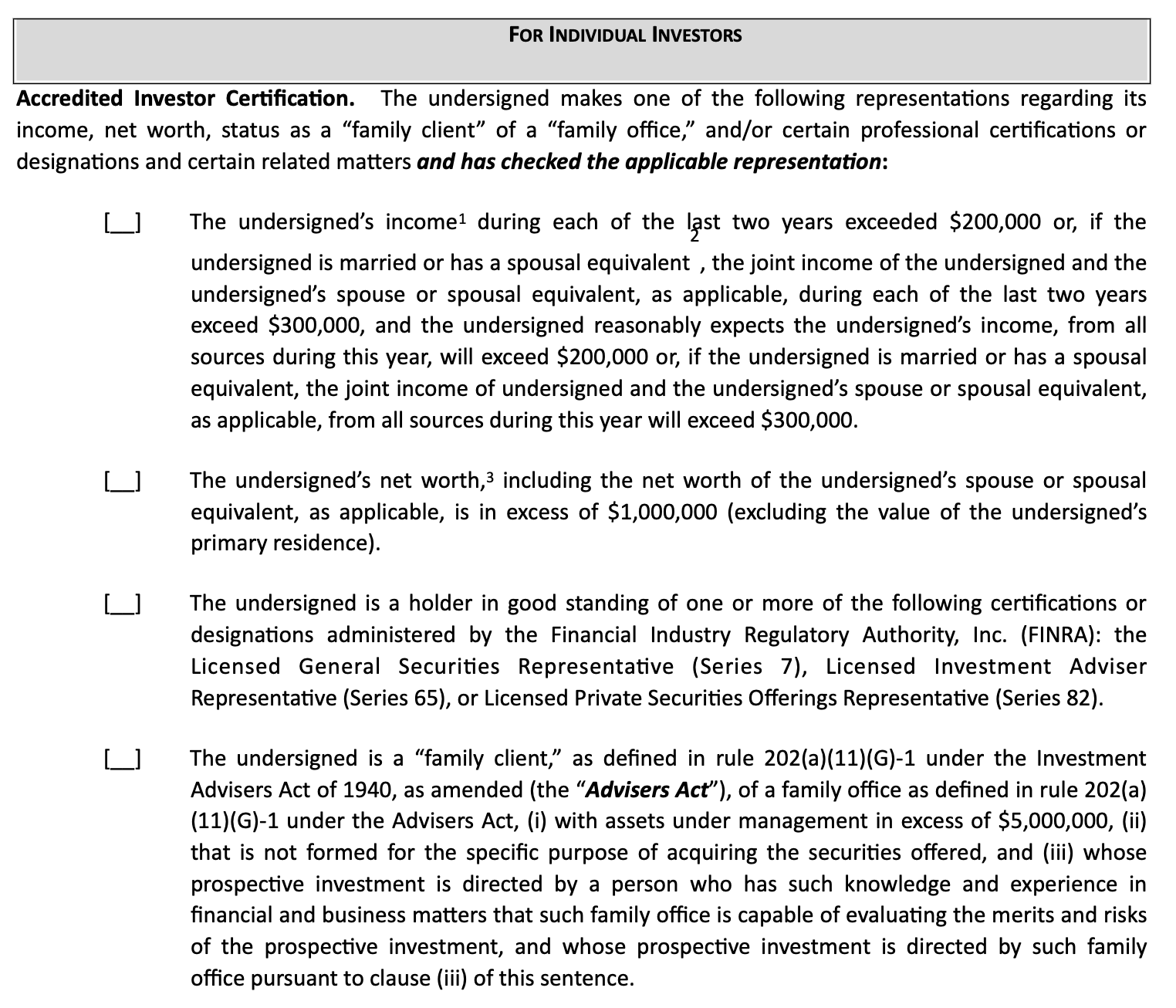

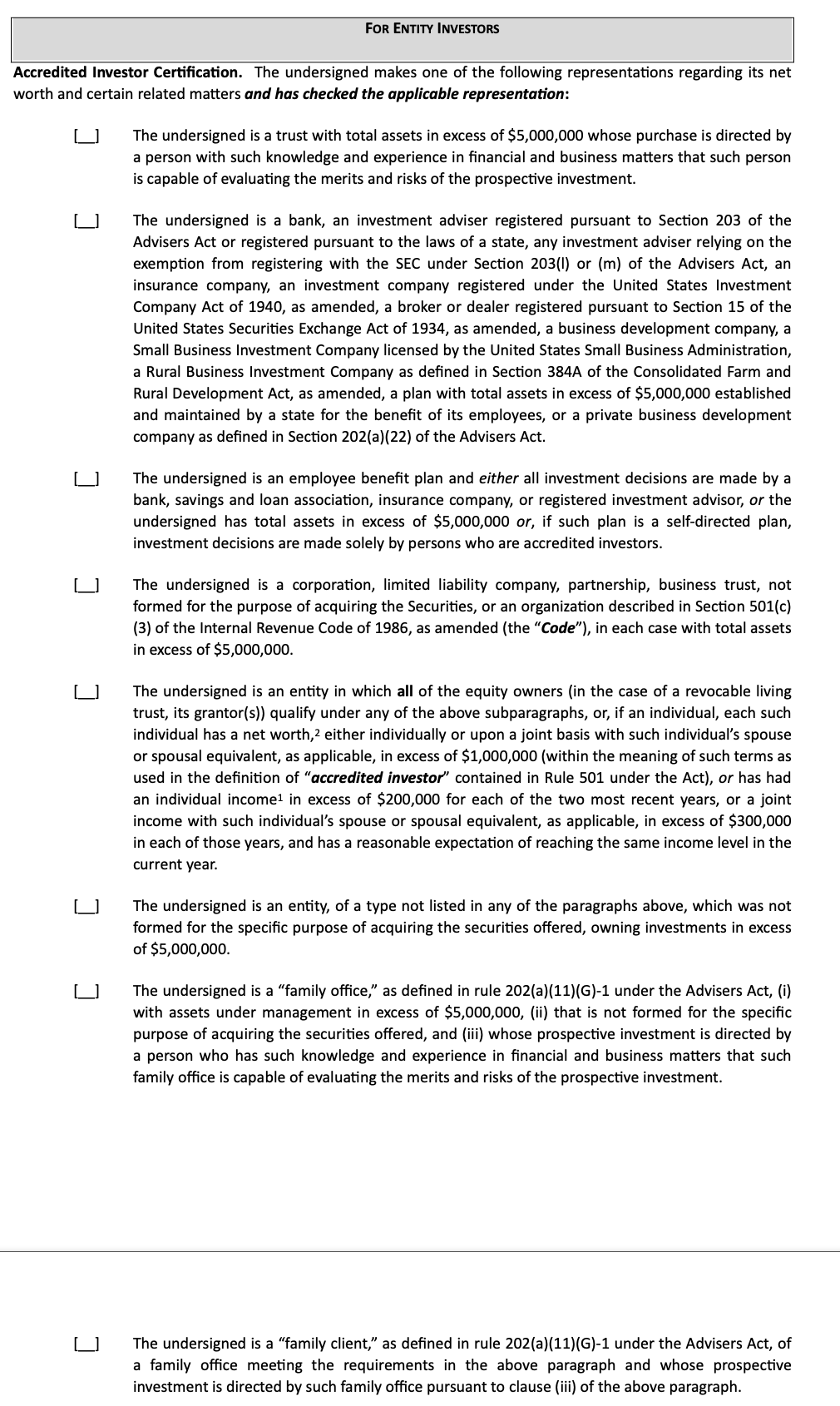

While the regulatory landscape is constantly changing, a path of clarity made by the SEC is the 506(b) exemption under Regulation D. Assuming any investment vehicle follows the guidelines outlined here, accredited investors can join a special purpose vehicle (SPV) to invest in a wide range of securities (startup equity, a venture capital fund, etc.). A core component of that guideline is for each investor to produce a self-accreditation questionnaire. This form asks questions about an individual’s income, net worth, or knowledge that qualifies them to be an accredited investor. A similar set of questions exist for entities (LLCs, CCORPs, etc.). Here’s a sample of one below:Accredited Investor Questions for Individuals and Entities

Accredited Investor Questions for Individuals and Entities

Courtesy of our friends at Cooley, LLP.

Self Accreditation in Zero Knowledge

Seed Labs’ self-accreditation in zero knowledge technology fundamentally changes this paradigm. We couple the latest in zero knowledge proof cryptography with the open verifiability of EVM-blockchains to enable a trustless claim of an individual or entity’s accreditation status. With our product, the following is possible: Interoperability: our proof technology ends up as metadata onto industry-standard ERC-721 contracts. This enables any project— web2, web3, within or outside of Seed Labs— to build products for you (fund administration services, consumer experiences, deal flow communities). Open verification: no regulator, fund administrator, deal lead, or fellow investor ever needs to trust a venture tooling company again. Instead, anyone can verify for themselves that a user truly claimed to be an accredited investor. Next-generation privacy: you never have to trust our servers or our data integrity policy to ensure your information doesn’t go into the wrong hands. Your personal information never leaves your local device. A hash of the computation over that data, instead, is stored publicly, which is impossible to reverse thanks to our ZK-SNARKs technology.How It Works

1

Fill out the accredited investor questionnaire

This data never leaves the client. (this can be validated by monitoring the network logs)

2

Compute a zero knowledge proof.

In one click, you’ll run your accreditation data through the zero knowledge circuit to determine if you qualify as an accredited investor.

3

Upload the proof to an immutable server.

We upload the proof output to IPFS, an always-alive distributed data storage protocol validated for security by hundreds of thousands of computers.

4

Upload the proof location to an eternal ledger.

You’ll mint an ERC-721 with the content identifier of the IPFS data as metadata.